Memorial Maintains Strong Financial Position

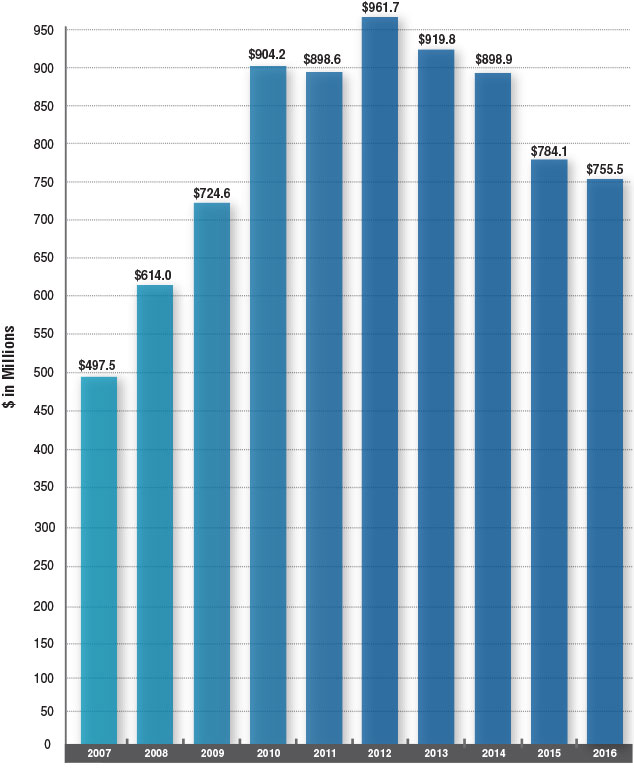

Memorial Healthcare System (“Memorial”) ended fiscal year 2016 (May 1, 2015 through April 30, 2016) with continued improvement on its already strong financial position. We remain one of a few comparable public healthcare systems with Aa3/AA or higher bond ratings by Moody’s and Standard & Poor’s, respectively. In March 2016, Standard & Poor’s upgraded its credit rating for Memorial to AA from AA- . In May 2016, Moody’s affirmed its Aa3 credit rating and changed its outlook for Memorial to “positive” from “stable.” These achievements are the result of many factors, including efficient business operations, a strong balance sheet, and key strategies to develop specialized services to attract patients from the primary market and beyond.

This solid financial base allows Memorial to help shoulder the financial burden of providing a high level of uncompensated care. It also enables the development and support of leading-edge facilities and services, recruitment of outstanding employees and the ability to uphold its mission as the “safety net” healthcare provider in south Broward County.

Memorial’s financial strength also enabled its Board of Commissioners to continue its multiyear history of providing tax relief to the taxpayers in south Broward County. In September 2015, the Board of Commissioners voted to adopt a millage rate of 0.1737 for fiscal year 2016 — the lowest in Memorial’s history.

The millage rate for fiscal year 2016 resulted in a gross levy of $8.1 million and, after accounting for discounts on taxes paid early and uncollectible taxes, generated approximately $7.7 million in taxes paid by district residents. Memorial netted no net tax revenue, however, as all $7.7 million was used to pay the required matching funds for the Medicaid program, support community redevelopment agencies in several municipalities, and pay for property appraiser fees and revenue collection fees.

Uncompensated Care

© 2016 Memorial Healthcare System